Choosing the right insurance provider is crucial for your financial safety. Travelers Insurance is a top choice for many Americans. But is it really as good as people say? In this review, we’ll explore their coverage, customer satisfaction, claims process, and more. This will help you decide if Travelers is right for you.

Key Takeaways

- Travelers Insurance is a well-established provider with a long history in the industry.

- The company offers a wide range of insurance products, including auto, home, and business coverage.

- Customer satisfaction ratings for Travelers are generally positive, though there are some mixed reviews.

- The claims process with Travelers is reported to be efficient, with many customers praising the company’s responsiveness.

- Factors like location, coverage needs, and personal preferences will determine if Travelers is the best fit for you.

Is Travelers Insurance Good?

Choosing an insurance provider is a big decision. Travelers Insurance is well-known for its wide coverage and good customer service. Let’s look at what makes it a good option.

Travelers Insurance is financially stable, which is key. It has high ratings from A.M. Best, S&P Global, and Moody’s. This shows it can handle risks well.

Customers also like Travelers Insurance. They say it’s good at handling claims and has helpful agents. People appreciate how quickly they get help.

| Metric | Travelers Insurance | Industry Average |

|---|---|---|

| Customer Satisfaction | 4.2 out of 5 | 3.8 out of 5 |

| Financial Strength Rating | A++ (Superior) | A (Excellent) |

| J.D. Power Ranking | 4 out of 5 | 3.5 out of 5 |

Travelers Insurance is also recognized in the industry. It has won many awards. Its focus on innovation and customers has helped its reputation.

In summary, Travelers Insurance is a good choice for those looking for solid coverage. It’s financially stable and has happy customers. But, it’s smart to compare other options to find what’s best for you.

Overview of Travelers Insurance

Travelers Insurance Company History

Travelers Insurance started in 1853 in Hartford, Connecticut. It began by offering accident insurance to railroad passengers. Now, it provides many insurance products like auto, home, life, and business coverage.

Types of Insurance Offered by Travelers

Travelers Insurance offers a wide range of insurance solutions. These meet the needs of both individuals and businesses. Here are some of the key products:

- Auto Insurance: Covers your vehicle, including liability, collision, and comprehensive protection.

- Homeowners Insurance: Protects your home, belongings, and liability exposures.

- Life Insurance: Provides financial security for your loved ones with term, whole life, and universal life policies.

- Business Insurance: Covers the risks and liabilities of small businesses, including property, liability, and workers’ compensation.

- Specialty Insurance: Offers coverage for specific needs, like boat, motorcycle, and umbrella liability insurance.

Travelers Insurance is a trusted partner for reliable and comprehensive coverage. It has a wide range of insurance solutions for individuals and businesses.

| Insurance Product | Key Features |

| Auto Insurance | Liability coverage Collision and comprehensive protection Roadside assistance Rental car reimbursement |

| Homeowners Insurance | Dwelling coverage Personal property protection Liability coverage Additional living expenses |

| Life Insurance | Term life insurance Whole life insurance Universal life insurance Customizable coverage amounts |

Travelers Insurance Coverage

Travelers Insurance offers a wide range of coverage options. They have plans for your home, car, or business. Each plan is designed to give you the protection you need.

Travelers Insurance is known for its flexibility. You can customize your policy to fit your needs and budget. This means you can choose the coverage that’s right for you.

| Coverage Type | Key Features |

| Auto Insurance | Liability coverage Collision and comprehensive coverage Uninsured/underinsured motorist protection Roadside assistance |

| Homeowners Insurance | Dwelling coverage Personal property protection Liability coverage Additional living expenses |

| Business Insurance | General liability coverage Property coverage Workers’ compensation Professional liability |

Travelers Insurance also offers specialized policies. These include life insurance, umbrella coverage, and flood insurance. They aim to protect what’s most important to you.

Travelers Insurance’s coverage is tailored to your needs and budget. Whether it’s for personal or business use, they offer peace of mind. Their travelers insurance coverage options are designed to protect you.

Travelers Insurance Reviews

Customer reviews and satisfaction ratings are key to understanding Travelers Insurance. They show the company’s strengths and weaknesses. By looking at both good and bad feedback, we can see what Travelers does well and what it can improve on.

Customer Satisfaction Ratings

Travelers Insurance gets mostly positive reviews. It has a 4.2 out of 5-star rating on Trustpilot. People like how fast they process claims and how good the customer service is.

Positive and Negative Reviews

Travelers Insurance reviews show both good and bad experiences. Many are happy with the prices, coverage, and online tools. They also like how quickly Travelers handles claims and the help from agents.

But, some have had trouble with claims. They say it takes too long or is hard to get approved. A few also mention issues with communication and customer service.

| Positive Reviews | Negative Reviews |

|---|---|

|

|

Travelers Insurance has a good reputation with many happy customers. But, it could work on improving claims handling and customer service. This would make it even better for everyone.

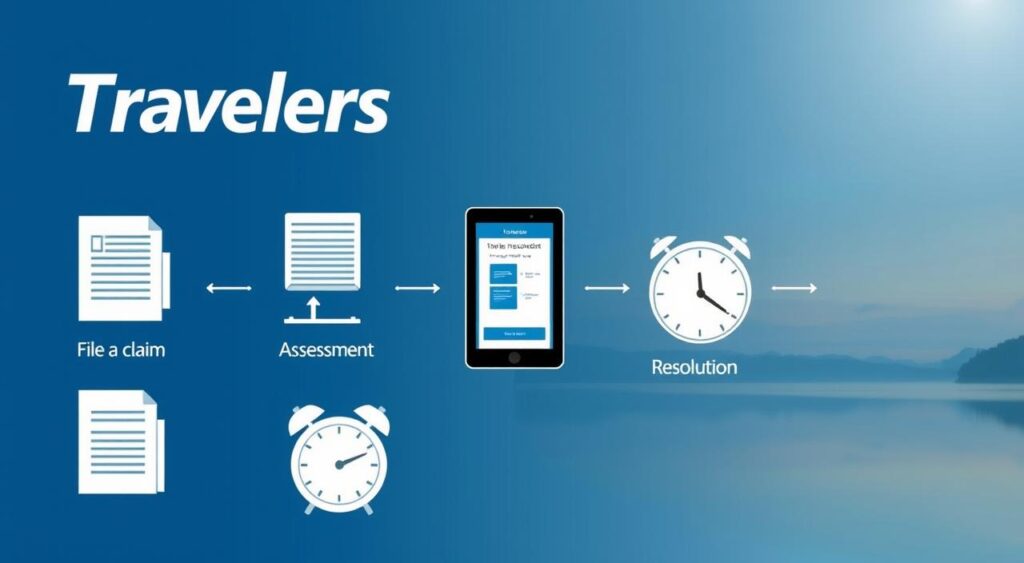

Travelers Insurance Claims Process

Filing an insurance claim can seem tough, but Travelers Insurance aims to make it easy. They want to ensure that filing a claim with them is straightforward and quick.

How to File a Claim with Travelers

The steps to file a claim with Travelers are simple:

- Report the Claim: You can start by telling Travelers about your claim online, through their app, or by phone.

- Provide Necessary Information: You’ll need to give them the details of what happened, like when and where it happened, and what happened.

- Schedule an Inspection (if applicable): Depending on your claim, they might send someone to check the damage.

- Submit Supporting Documentation: You might need to send them more stuff, like receipts or photos.

- Claim Review and Settlement: Travelers will then figure out how much to pay you, and they’ll pay it out to you or the repair person.

Travelers has people ready to help you through the whole process. They work hard to settle claims fast and fairly, so you get the help you need.

| Claim Type | Typical Resolution Time |

|---|---|

| Auto Accident | 7-10 business days |

| Home Damage | 10-14 business days |

| Theft or Vandalism | 14-21 business days |

The time it takes to settle a claim can change. It depends on how complex the case is and if they have all the info they need.

Travelers Insurance Policies

Travelers is a top insurance provider with a wide range of travelers insurance policies. They offer everything from home and auto coverage to plans for specific industries. This means customers get protection that fits their needs, giving them peace of mind.

Personal Insurance Policies

Travelers has many personal insurance options:

- Homeowners Insurance: Protects your home, belongings, and you from various risks.

- Auto Insurance: Covers your car, including accidents and damage.

- Life Insurance: Helps secure your family’s financial future with different types of policies.

- Renters Insurance: Safeguards your personal items and liability when you rent.

Business Insurance Policies

Businesses get a wide range of travelers insurance policies from Travelers:

- Commercial Property Insurance: Protects your business’s physical assets, like buildings and equipment.

- General Liability Insurance: Shields your business from claims of injury or damage to others’ property.

- Workers’ Compensation Insurance: Covers medical costs and lost wages for employees injured on the job.

- Professional Liability Insurance: Protects your business from claims of professional mistakes or negligence.

| Policy Type | Key Features | Coverage Limits |

|---|---|---|

| Homeowners Insurance | – Dwelling coverage – Personal property protection – Liability coverage | – Up to $500,000 for dwelling – Up to $250,000 for personal property – Up to $500,000 for liability |

| Auto Insurance | – Liability coverage – Collision and comprehensive coverage – Uninsured/underinsured motorist protection | – Up to $250,000/$500,000 for bodily injury – Up to $100,000 for property damage – Up to $100,000/$300,000 for uninsured/underinsured motorist |

| Business Owner’s Policy (BOP) | – Property coverage – General liability coverage – Business interruption coverage | – Up to $1 million per occurrence for liability – Up to $500,000 for property damage |

Travelers offers a wide range of travelers insurance policies. This lets customers choose the right coverage for their needs. They can protect their assets and ensure financial security.

Travelers Insurance Costs and Discounts

When looking at travelers insurance costs, many things can change your rates. Your coverage, driving history, and deductibles all play a part. Travelers Insurance also has discounts to help lower your costs.

Factors Affecting Travelers Insurance Premiums

The factors affecting travelers insurance premiums include:

- Coverage levels: Higher coverage limits mean higher premiums.

- Deductibles: Choosing a higher deductible can lower your monthly payments.

- Driver history: Drivers with clean records and fewer claims get better rates.

- Vehicle type: The make, model, and age of your vehicle affect costs.

- Location: Where you live and local crime/accident rates can change premiums.

Knowing these factors helps you tailor a policy that fits your needs and budget with Travelers.

Travelers Insurance Discounts

Travelers offers discounts to help lower travelers insurance costs, including:

- Multi-policy discount: Bundling auto, home, and other policies with Travelers.

- Safe driver discount: For drivers with few or no claims.

- Good student discount: For full-time students with a B average or higher.

- Defensive driving course discount: For those who complete an approved course.

- Automatic payment discount: For those who enroll in automatic electronic payments.

These discounts can save you hundreds of dollars on travelers insurance costs each year.

Looking into factors affecting travelers insurance premiums and discounts can help you find affordable coverage. By working with Travelers, you can customize your policy to save money. This way, you get the protection you need without breaking the bank.

Travelers Insurance Customer Service

Reliable customer service is key when it comes to insurance. Travelers Insurance knows this and offers many ways to help. They have travelers insurance customer service reps ready to talk by phone. They also have online tools for easy access.

Contact Options and Availability

Travelers Insurance has several travelers insurance contact options for you:

- 24/7 phone support with knowledgeable customer service representatives

- Online chat functionality for quick inquiries

- A comprehensive website with self-service resources and FAQs

- A mobile app for easy access to policy information and claims management

- Email support for more detailed questions or concerns

Their customer service team is quick to respond and solve problems. You can count on them for help, whether by phone, online, or email.

| Contact Method | Availability |

|---|---|

| Phone | 24/7 |

| Online Chat | Monday-Friday, 8 AM – 8 PM EST |

| Monday-Friday, 8 AM – 6 PM EST | |

| Mobile App | 24/7 |

Travelers Insurance makes it easy to get help when you need it. They offer many travelers insurance contact options. This dedication to customer service helps them stand out.

Comparing Travelers Insurance to Other Providers

Choosing the right insurance provider is key. It’s important to compare Travelers Insurance with others. This helps you find the best fit for your needs and budget.

Travelers Insurance offers a wide range of products. This includes auto, home, life, business, and umbrella insurance. Having all these options in one place can be very convenient.

| Insurance Provider | Auto Insurance Rates | Homeowners Insurance Rates | Customer Satisfaction |

|---|---|---|---|

| Travelers Insurance | $1,200 per year | $1,500 per year | 4.2 out of 5 stars |

| State Farm | $1,300 per year | $1,600 per year | 4.1 out of 5 stars |

| Allstate | $1,400 per year | $1,700 per year | 3.9 out of 5 stars |

Travelers Insurance is often seen as a cost-effective choice. They offer competitive rates for auto and home insurance. They also have discounts and bundling options to save even more.

Customers often praise Travelers Insurance for their claims process and customer service. But, it’s important to look at individual experiences to get a full picture.

By comparing Travelers Insurance to other providers, you can make a smart choice. Whether you need auto, home, or specialized insurance, knowing what Travelers offers can help you find the right fit.

Travelers Insurance Quotes and Online Tools

Travelers Insurance has made it easy for customers to manage their insurance online. They offer quick travelers insurance quotes and a digital account to manage policies. This makes the insurance experience convenient and easy to use.

Getting a quote from Travelers is simple. Just visit their website and enter your details. You’ll get travelers insurance quotes that fit your needs. This way, you can compare and choose the best policy for you.

Travelers also has travelers insurance online tools for managing your account. Log in to see your policy, pay bills, and even file claims online. It’s great for those who like to manage things online.

| Travelers Insurance Online Tools | Description |

|---|---|

| Online Quoting Tool | Allows customers to obtain personalized travelers insurance quotes based on their information |

| Digital Policy Management | Enables policyholders to view, manage, and update their Travelers Insurance policies online |

| Online Claim Reporting | Provides a convenient way for customers to file claims through the Travelers Insurance website |

| Mobile App | Offers a mobile-friendly platform for accessing travelers insurance online tools on-the-go |

Travelers Insurance uses digital tools to make managing insurance easy. They want to give customers a smooth and efficient experience. This way, you can handle your insurance with no hassle.

Pros and Cons of Travelers Insurance

When thinking about Travelers Insurance, it’s key to look at both sides. This helps decide if it fits your insurance needs. Let’s dive into the main points of this provider.

Pros of Travelers Insurance

- Comprehensive coverage options: Travelers has many insurance products like auto, home, life, and business. This makes it easy to manage your insurance.

- Financial stability: Travelers is a trusted and established company. This means they can handle their financial commitments.

- Customizable policies: You can adjust your insurance to fit your needs. This way, you only pay for what you need.

- Positive customer reviews: Many people are happy with Travelers. They like how they handle claims and provide service.

Cons of Travelers Insurance

- Potentially higher premiums: Your location, personal details, and coverage needs can affect your premiums. Travelers might be pricier than some others.

- Limited availability in some areas: Travelers might not be in every place. This could limit your choices.

- Complex claims process: Some find it hard to deal with Travelers’ claims process. It can be slow and frustrating.

- Limited online tools: Travelers might not have as many online tools as some competitors. This can make managing your policies harder.

Choosing Travelers Insurance depends on your insurance needs, budget, and preferences. Knowing the pros and cons helps you make a choice that fits you best.

| Pros of Travelers Insurance | Cons of Travelers Insurance |

|---|---|

| Comprehensive coverage options | Potentially higher premiums |

| Financial stability | Limited availability in some areas |

| Customizable policies | Complex claims process |

| Positive customer reviews | Limited online tools |

“Travelers Insurance has given me reliable coverage and great service for years. Being able to customize my policies is a big plus.”

Is Travelers Insurance Right for You?

Figuring out if Travelers Insurance is right for you involves looking at a few key things. You need to think about what coverage you need, how much you can spend, and what you personally prefer. By comparing Travelers’ options to your own needs, you can decide if it’s the best choice for you.

First, check if Travelers offers the coverage you need. They have a wide range of products, like auto, home, life, and business policies. Make sure they can protect you and your stuff well.

Next, look at how Travelers handles customer service and claims. What others say about their experience can tell you a lot. This can help you see if you’ll be happy with their service.

Don’t forget about cost. Travelers has different discounts and prices. But, it’s smart to compare their rates with others to make sure you’re getting a good deal. Think about what you need and how much you can spend to find the best policy.

In the end, deciding if Travelers Insurance is right for you means weighing their good points against your own needs and wants. By carefully looking at these things, you can choose a policy that fits you well.

Key Considerations for Determining if Travelers Insurance is Right for You

- Evaluate the breadth of coverage Travelers offers to ensure it meets your specific insurance needs.

- Review Travelers’ customer service and claims handling reputation to gauge their level of responsiveness and transparency.

- Compare Travelers’ rates and pricing options with other insurers to find the best value for your budget and coverage requirements.

- Assess how Travelers’ offerings and reputation align with your personal preferences and insurance priorities.

| Factors to Consider | Travelers Insurance | Competitor A | Competitor B |

|---|---|---|---|

| Coverage Options | Comprehensive | Limited | Moderate |

| Customer Satisfaction | High | Average | Low |

| Pricing | Competitive | Higher | Lower |

“Travelers Insurance has provided me with reliable coverage and exceptional customer service. I highly recommend them to anyone looking for a trusted insurance provider.”

Conclusion

Travelers Insurance offers a wide range of insurance products and services. It has a long history and is known as a trusted brand. They provide many coverage options, from auto and home to business and specialty policies.

Customers often give positive reviews, and the company has strong financial ratings. This shows Travelers Insurance is a reliable choice for quality protection. But, it’s important to think about your specific insurance needs and compare Travelers with other providers.

If you’re looking for is travelers insurance good or just want to see what’s out there, this travelers insurance review has you covered. It gives you the info you need to make a smart choice about your insurance. By looking at the pros and cons, understanding claims, and checking costs and service, you can decide if Travelers is right for you.

FAQ

How does Travelers Insurance compare to other insurance providers?

Travelers Insurance offers many coverage options and competitive prices. But, it’s key to compare it with other top insurers to find the best fit for you. Look at customer satisfaction, financial health, and special policy features.

What types of insurance does Travelers offer?

Travelers Insurance has a wide range of products. This includes auto, home, life, business, and specialty coverages. They’ve been in the business for a long time and offer many policy options to meet different customer needs.

How do I file a claim with Travelers Insurance?

Filing a claim with Travelers is easy and fast. You can do it online, through their app, or by calling their customer service. They have a team ready to help you with your claim quickly and fairly.

What factors affect the cost of Travelers Insurance premiums?

Several things can change your premium costs. These include your coverage limits, deductibles, driving record, location, and policy type. They also offer discounts to help lower your premiums.

How does Travelers Insurance rate in terms of customer satisfaction?

Travelers Insurance gets mostly positive reviews from customers. They praise their customer service, claims handling, and policy offerings. But, it’s also good to look at some negative reviews to get a full picture.

What is the history and background of Travelers Insurance?

Travelers Insurance has a rich history, starting in 1853. Over the years, it has grown to be one of the biggest and most respected insurers in the U.S. They offer a wide range of insurance products and services.

What is the coverage provided by Travelers Insurance policies?

Travelers Insurance has many coverage options. This includes auto, home, life, business, and specialty insurance. Their policies aim to protect customers from various risks, with customizable levels and features.

How can I get a quote or apply for Travelers Insurance?

Getting a quote or applying for coverage with Travelers is easy. You can do it online, through their website or app. Or, you can talk to a local agent or call their customer service for personalized advice.