In the world of corporate finance, “mezzanine debt” is a term that catches many people’s attention. But what is it, and how does it work? Let’s explore the details of mezzanine debt, including its features, uses, and the pros and cons for both sides.

Key Takeaways

- Mezzanine debt is a mix of debt and equity financing, blending both.

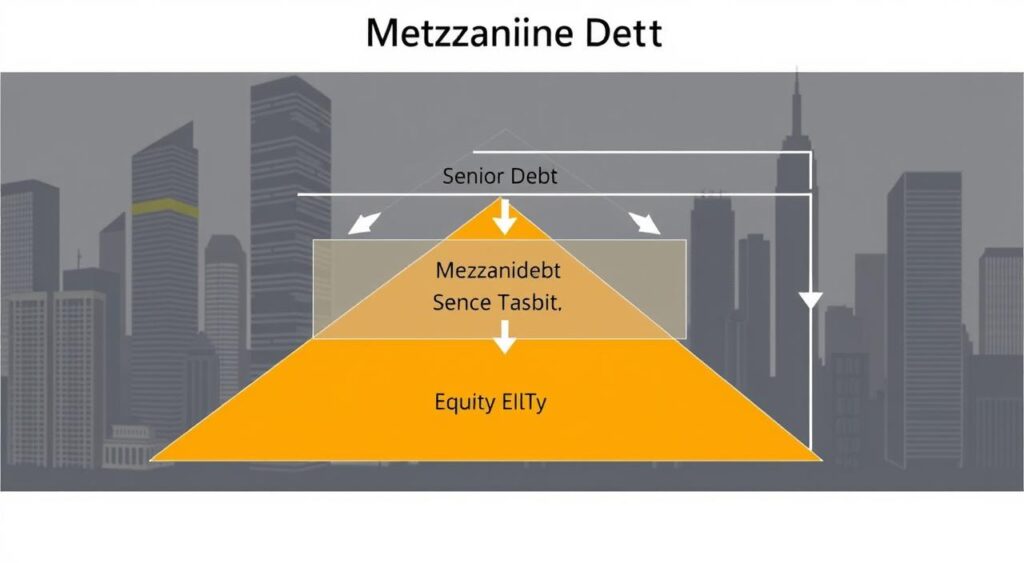

- It sits between senior debt and common equity in a company’s structure.

- Mezzanine debt usually offers higher returns, between 12% to 20% annually.

- It’s often used in buyouts, mergers, and business growth.

- Mezzanine debt offers flexibility and tax benefits for borrowers but is riskier for lenders.

Introduction to Mezzanine Debt

Mezzanine debt is a special kind of financing that falls between debt and equity. It combines the best of both worlds. Companies use it to grow, buy other businesses, or change ownership.

Understanding Mezzanine Debt’s Position Between Debt and Equity

Mezzanine debt is more senior than equity but less than senior debt. It’s riskier than senior debt but can offer better returns. It usually lasts 7-8 years and often doesn’t require payments until the end.

Key Characteristics of Mezzanine Financing

- Subordinate to senior debt but has priority over preferred and common stock

- Carries higher yields than traditional debt, often ranging between 12% to 20%

- Frequently unsecured and subordinated to a company’s senior debt

- Utilized for a variety of purposes, including recapitalizations, buyouts, and growth capital

- Structured as a blend of senior debt and equity, with a mix of contractual interest and equity-like warrants

Mezzanine financing is good for both sides. It helps companies grow and save money. Investors get high returns and a chance to own part of the company.

But, mezzanine financing comes with risks. Companies might lose control or fail. Investors face high risks and long waits for returns.

Types of Mezzanine Debt

Mezzanine debt is a financing option that businesses find useful. It comes in different forms like subordinated debt, hybrid debt, and quasi-equity financing. Each type has its own features and uses.

Subordinated debt is a mix between debt and equity. It’s paid back after senior lenders are repaid. Because of this, it has a higher interest rate to balance out the risk.

Hybrid debt blends debt and equity. It might include stock options or warrants. This way, lenders can share in the business’s growth. Hybrid debt gives businesses a way to get capital while keeping some control.

Quasi-equity financing is similar to equity. It might involve profit-sharing or revenue-based repayments. This type is great for businesses wanting to grow without giving up control.

Choosing the right mezzanine debt can help businesses grow. It’s a flexible way to get the funds needed for expansion.

| Type of Mezzanine Debt | Key Characteristics |

|---|---|

| Subordinated Debt | – Sits between traditional debt and equity in the capital structure – Repaid after senior debt is satisfied – Carries higher interest rates to compensate for increased risk |

| Hybrid Debt | – Combines features of both debt and equity – May include stock options, warrants, or convertible features – Allows lender to participate in the upside potential of the business |

| Quasi-Equity Financing | – Closely resembles equity in its characteristics – May include profit-sharing arrangements or revenue-based repayment – Aligns the interests of the lender and the borrower |

These types of mezzanine debt offer businesses a flexible way to finance. They allow for growth while keeping control and ownership.

How Mezzanine Debt Works

Mezzanine financing sits between senior debt and common stock in a company’s capital structure. It’s often in the form of subordinated debt or preferred equity. The most common type is unsecured subordinated debt. This means it ranks below more senior loans or securities in claiming assets or earnings.

Mezzanine Financing Structure

Mezzanine financing often includes options like warrants or convertible features. This gives lenders a chance to get equity. It’s usually unsecured and has higher interest rates because of its riskier nature compared to senior debt.

Maturity, Redemption, and Transferability

Mezzanine financing usually matures in five years or more. The maturity date often depends on the existing debt in the issuer’s structure. Preferred equity, on the other hand, doesn’t have a fixed maturity date but can be called by the issuer.

Redemption is often done to take advantage of lower market rates. Mezzanine debt lenders can usually transfer their loan freely. However, preferred equity may have restrictions or conditions on transferring the purchaser’s interest.

| Key Characteristic | Description |

|---|---|

| Mezzanine Debt Position | Ranks between senior debt and equity in the capital structure |

| Mezzanine Debt Structure | Typically unsecured subordinated debt with embedded options like warrants or convertible features |

| Mezzanine Debt Maturity | Typically matures in 5 years or more, dependent on existing debt maturities |

| Mezzanine Debt Redemption | Redemption often exercised to take advantage of lower market rates |

| Mezzanine Debt Transferability | Lenders generally have unrestricted right to transfer, while preferred equity is often subject to restrictions |

Advantages of Mezzanine Financing

Mezzanine financing is a great option for businesses. It lets you get funding without giving up control. Lenders get equity warrants or convertible features, so they can share in your success later.

Another big plus is that interest payments are tax-deductible. This is different from equity financing. It means your business can keep more money and stay profitable.

Mezzanine financing also offers flexible repayment terms. This is helpful if you’re facing cash flow issues or want to grow. You can delay interest payments if needed.

It also lets you finance intangible assets like intellectual property. This is something traditional loans can’t cover. It helps your business grow without being tied down by usual financing rules.

“Mezzanine financing increases leverage in a deal, potentially boosting an investor’s Return on Equity (ROE), such as from 9% to 9.75% in a $10M property deal.”

In summary, mezzanine financing offers many benefits. It can lead to higher returns, tax savings, and flexible payment plans. It’s a smart choice for businesses looking to grow without losing control or equity.

| Advantages of Mezzanine Financing | Benefits |

|---|---|

| Equity Participation | Mezzanine lenders can receive equity warrants or convertible features, allowing them to participate in the company’s future success without an immediate transfer of equity. |

| Tax Deductibility | The interest paid on mezzanine debt is considered a tax-deductible business expense, providing a financial advantage for borrowers. |

| Flexible Repayment Terms | Mezzanine financing allows borrowers to defer interest payments if needed, accommodating temporary cash flow challenges or growth opportunities. |

| Financing Intangible Assets | Mezzanine debt can be used to finance unsecured intangible assets, such as intellectual property or brand value, which may not be eligible for traditional loan collateral. |

| Increased Leverage and ROE | Mezzanine financing can increase leverage in a deal, potentially boosting an investor’s Return on Equity (ROE). |

Disadvantages of Mezzanine Financing

Mezzanine financing can give businesses the capital they need. But, it also has downsides that entrepreneurs should think about. One big disadvantage of mezzanine financing is losing control and upside because of giving up equity.

Mezzanine lenders want a say in the company’s decisions. They can also put limits on what the borrower can do. This means the borrower has less freedom to make choices. Also, mezzanine debt drawbacks include the risks of mezzanine financing. Mezzanine lenders are at a higher risk of losing their money if the company goes bankrupt.

Getting mezzanine debt can be complicated and time-consuming. It requires a lot of legal and financial knowledge. This can lead to higher costs for the borrower.

- Potential loss of equity and control in the company

- Restrictive covenants and lender oversight

- Subordinate position to senior debt holders, increasing risk of loss in bankruptcy

- Complexity of mezzanine financing structures and negotiations

- Higher transaction costs due to the need for specialized expertise

Businesses thinking about mezzanine financing need to weigh the pros and cons. They should make sure it’s the best choice for their future growth and success.

“Mezzanine financing can be a double-edged sword for businesses, offering much-needed capital but also introducing complex trade-offs that must be carefully navigated.”

What is Mezzanine Debt?

Mezzanine debt is a special kind of financing that falls between traditional debt and equity. It mixes debt and equity features, offering companies a flexible funding option. This is different from usual bank loans.

Mezzanine financing is a type of debt that is not secured by assets. It ranks above equity but below senior debt in a company’s structure. It’s based on the company’s value, not just its assets. This value is estimated by its cash flows and growth potential.

| Key Characteristics of Mezzanine Debt | Description |

|---|---|

| Position in Capital Structure | Ranks above equity but below senior debt |

| Secured vs. Unsecured | Typically unsecured, with no collateral |

| Interest Rates | Higher than senior debt due to increased risk |

| Embedded Options | Often includes warrants or convertible features |

| Repayment Priority | Paid after senior debt holders in case of default |

The mezzanine financing definition highlights its unique features. Knowing what is mezzanine debt helps businesses make better funding choices. This way, they can grow and expand with the right financial support.

Mezzanine Debt Structuring Examples

Mezzanine debt is a strong financing tool for many needs. It’s used for buying companies and growing businesses. Let’s look at two examples that show how mezzanine financing works:

Example 1: Acquisition Financing

Imagine a company wants to buy another for $100 million. A bank might only lend 75% of that, leaving a $25 million gap. A mezzanine investor could fill this gap with $15 million. This means the buyer only needs to put in $10 million themselves.

Example 2: Business Expansion

An entrepreneur wants $10 million to grow their business. They’ve already gotten $5 million in senior debt and have $3 million in equity. But they still need $2 million. Mezzanine financing can help when getting more equity or senior debt is hard.

In these examples, mezzanine debt is a flexible way to get the money needed. It helps businesses grow without needing too much cash upfront.

| Mezzanine Financing Statistics | Value |

|---|---|

| Typical Senior Debt Loan-to-Value Ratio | 70% – 80% |

| Mezzanine Debt Interest Rates | 15% – 20% |

| Mezzanine Debt Return on Investment | 12% – 20% per year |

| Mezzanine Debt Tax Deductions | Can reduce effective rate to 13% |

These examples show how mezzanine debt can meet different financing needs. It’s used for mezzanine debt in acquisitions and mezzanine debt for business expansion. With mezzanine financing structures, businesses can get the money they need to grow.

Benefits of Mezzanine Financing for Investors

Mezzanine financing is great for investors looking for good returns and a balanced risk. It offers higher yields, often between 12% to 20% per year. This can beat the returns from traditional equity investments.

Mezzanine debt is more secure and less variable than equity. Investors get a fixed payment, which is paid in full. This gives a steady income, unlike the ups and downs of equity.

Mezzanine lenders can also mitigate risk by checking the borrower’s history and business plan. They might even get a share of the company through warrants or convertible terms.

Mezzanine debt is a fixed income alternative investment with high yields. It’s a good choice for diversifying a portfolio. By adding mezzanine financing, investors can boost their returns while keeping risk low.

“Mezzanine financing combines elements of both debt and equity funding, offering investors the potential for higher returns while mitigating risk through comprehensive due diligence and strategic structuring.”

In summary, the benefits of mezzanine financing for investors include:

- Potential for higher returns, typically ranging from 12% to 20% per year

- More secure and less variable returns compared to equity investments

- Ability to mitigate risk through due diligence and strategic structuring

- Diversification opportunities as a fixed income alternative investment

Benefits of Mezzanine Financing for Borrowers

Mezzanine debt is a great way for businesses to grow. It’s a mix between debt and equity, making it cost-effective. This helps companies expand without losing control.

One big plus is that borrowers can keep their business ownership. They get the money they need without losing too much control. This keeps their decision-making power strong.

Also, mezzanine financing is often tax-deductible. This makes it cheaper than equity financing. It helps companies save money, making their growth plans more affordable.

Mezzanine lenders also offer strategic assistance. They act as long-term partners, helping companies reach their goals. Their industry knowledge is a big plus.

The flexible repayment terms of mezzanine debt are another advantage. They let companies match their payments to their growth. This is great for fast-growing businesses, as it reduces financial pressure.

In summary, mezzanine financing is a smart choice for businesses. It helps them grow while keeping control and financial flexibility.

“Mezzanine debt has been a game-changer for our company, allowing us to grow without the need for excessive equity dilution. The flexible repayment terms and strategic guidance from our mezzanine lender have been invaluable in helping us achieve our ambitious goals.”

– John Smith, CEO of XYZ Corporation

The Role of Mezzanine Debt in Market Disruptions

Mezzanine financing has become a key player in times of market trouble, like the 2008 crisis and the COVID-19 pandemic. It’s a flexible debt option that traditional lenders often can’t match. This makes it a go-to for small and mid-market businesses looking to grow or make acquisitions.

Mezzanine debt stands out because of its flexible structure and the promise of higher returns. Mezzanine loans usually aim for returns between 10-20% per year. This is more than what senior debt and common equity investors typically offer.

Also, mezzanine debt’s junior position in the capital structure means it can provide extra funds when others are hesitant. This has been especially helpful during the COVID-19 pandemic. Many businesses needed new financing options due to the disruptions.

“Mezzanine financing has proven to be a resilient form of debt financing, supporting businesses through challenging market conditions.”

While mezzanine debt carries more risk, its ability to adapt and offer capital in tough times has made it more popular. As the economy keeps changing, mezzanine debt’s role in helping businesses through disruptions will likely stay important.

Conclusion

Mezzanine debt is a special kind of financing that mixes debt and equity. It helps businesses grow by providing funding for big projects. This way, companies can expand without losing control.

Investors find mezzanine debt appealing because it offers good returns and is safer than equity. This is especially true when banks are not lending as much. Mezzanine financing is a lifeline for businesses looking for alternative funding.

Knowing how mezzanine debt works is key for both businesses and investors. It helps them understand and use this financing option wisely. With mezzanine debt, companies can get the funds they need to grow. Investors can also add diversity to their portfolios and earn well.

FAQ

What is mezzanine debt?

Mezzanine debt is a mix of debt and equity. It lets lenders turn debt into equity if the company defaults. It sits between senior debt and equity in a company’s structure.

What are the key characteristics of mezzanine financing?

Mezzanine financing is key for several reasons. It’s below senior debt but above equity. It has higher yields than regular debt. It’s often unsecured and doesn’t require paying back the loan principal.

It can have both fixed and variable interest rates.

What types of equity are included with mezzanine debt?

Equity types with mezzanine debt vary. This includes stock call options, rights, and warrants. It acts more like stock than debt because of these options.

How is mezzanine financing structured?

Mezzanine financing fits between senior debt and common stock. It’s either subordinated debt or preferred equity. The most common form is unsecured subordinated debt.

What are the maturity and redemption terms of mezzanine debt?

Mezzanine debt usually lasts five years or more. Its maturity depends on existing debt. Preferred equity doesn’t have a fixed date but can be called by the issuer.

Redemption is often to take advantage of lower rates.

What are the advantages of mezzanine financing for borrowers?

Borrowers like mezzanine debt for several reasons. The interest paid is tax-deductible. Repayment terms are flexible, allowing deferral if needed.

It also finances unsecured intangible assets and supports growth without giving up more equity.

What are the disadvantages of mezzanine financing?

Business owners may lose control and upside with mezzanine debt. Lenders might want a board seat and impose strict rules. In bankruptcy, mezzanine lenders risk losing their investment.

How does mezzanine debt work in acquisition financing?

In an acquisition, a senior lender might only lend 75% of the deal’s value. This leaves a $25 million gap for a $100 million deal. A mezzanine investor can fill this gap, reducing the buyer’s cash contribution.

How does mezzanine debt help with business expansion?

An entrepreneur might need $10 million to grow their business. They’ve secured $5 million in senior debt and $3 million in equity. Mezzanine financing can cover the $2 million shortfall, helping the entrepreneur.

What are the benefits of mezzanine financing for investors?

Mezzanine financing offers high returns, between 12% to 20% per year. It’s more secure than equity, with a fixed return. Investors can also assess the borrower’s risk through due diligence.

How has mezzanine debt performed during market disruptions?

Mezzanine financing is flexible and resilient, especially in crises like 2008 and COVID-19. It’s a key alternative when traditional lenders are cautious. It supports growth and acquisitions for businesses.